How homeowners and buyers are unexpectedly impacted by the shutdown

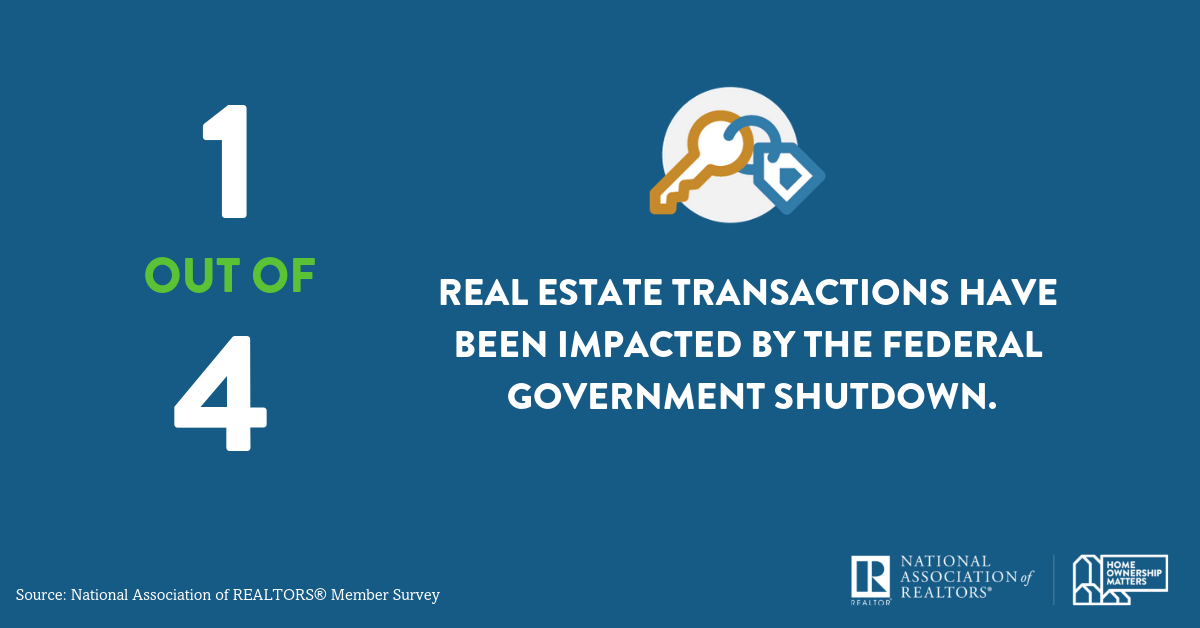

The U.S. government has been partially shutdown since just before Christmas and while that has adversely impacted federal programs, services and government employees, it’s also having a negative impact on the real estate market. While President Donald Trump and Congress continue to battle over the best way to fund the federal government, 1-in-4 (25%) real estate transactions have been impacted by the shutdown, according to a survey of REALTORS®.

Survey respondents indicated multiple reasons for how transactions have been impacted:

- 17 percent were because of delays related to a USDA loan.

- 13 percent were from delays related to IRS income verification – although the IRS announced on Jan. 8 that it would resume this practice, even during the shutdown.

- Nine percent were from delays related to FHA loans.

- Six percent were because of delays related to a VA loan.

- Six percent due to economic uncertainty.

- Three percent had a client who was unable to secure a loan because they were a furloughed.

REALTORS® also reported about five percent of the contracts terminated since the beginning of the shutdown were related to federal loans.

“The housing industry was already facing market challenges before any government closure,” National Association of REALTORS® (NAR) Chief Economist Lawrence Yun told Housing Wire. “The shutdown has made matters worse.” Yun also stated, “A home purchase is a major expenditure that simultaneously involves a high level of excitement and anxiety, and the current government shutdown adds another layer of unnecessary complication to the home buying process. The shutdown is causing tangible harm to potential buyers, the real estate market and economic growth.”

Researchers also published information about the following real estate-related agencies and the impact the shutdown is having on each:

- Environmental Protection Agency – With the EPA employees furloughed, issues related to lead-based paint in homes and how to disclose, renovate and repair those issues will be unavailable, creating delays.

- Federal Housing Administration – During the shutdown the Department of Housing and Urban Development (HUD) will not make any new commitments in the Multifamily Housing Development program. Loans in the Single-Family Mortgage Loan Program are still being endorsed by HUD.

- Rural Housing Programs – The U.S. Department of Agriculture is not issuing new rural housing direct loans or guaranteed loans during the shutdown. Scheduled closings of direct loans will not occur. Scheduled closings of guaranteed loans without the guarantee previously issued will be closed at the lender’s own risk.

Time to Focus on Affordable Housing

Taxes on real estate are not the answer. Sign the petition calling on Congress to address our country’s housing shortage.