Is Interest Still Deductible On Home Equity Lines Of Credit?

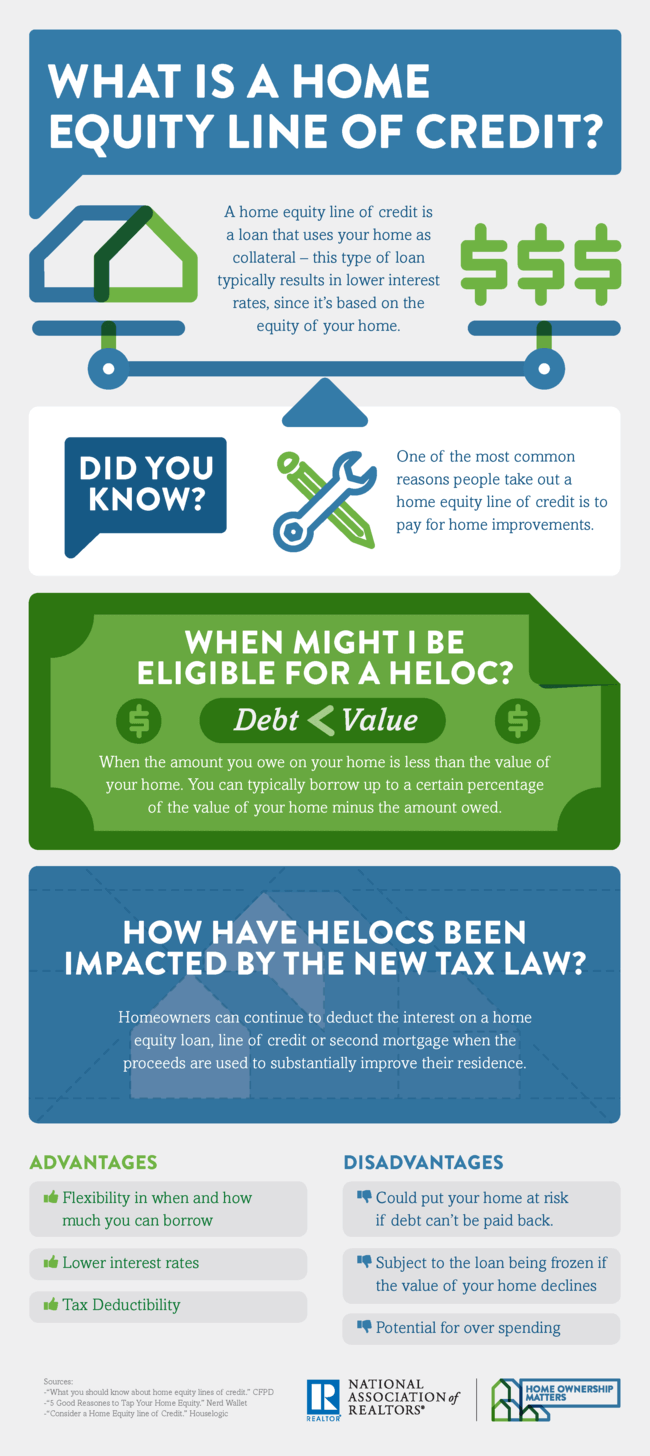

The IRS has recently clarified and confirmed that under the new tax law owners can continue to deduct the interest on a home equity loan, line of credit or second mortgage when the proceeds are used to substantially improve their residence.

“There has been much confusion on this issue, and the continued deductibility will bring real benefits to those who choose to take on remodeling projects to bring more resale value to their home or gain equity that may have been lost during the downturn,” said National Association of Realtors® President Elizabeth Mendenhall.

Homeowners sometimes decide they want to borrow against the value of their home to help remodel or pay for other large expenses. One way to do this is with a Home Equity Line of Credit (HELOC).

Here are some resources on the web to help you decide if a HELOC is a good option for you:

- What you should know about home equity lines of credit

From the CFPB

“If you are in the market for credit, a home equity plan is one of several options that might be right for you. Before making a decision, however, you should weigh carefully the costs of a home equity line against the benefits.” - 5 Good Reasons to Tap Your Home Equity

From Nerd Wallet

“Lenders want you to borrow against your home equity again. The question is, should you? …HELOCs are typically a cheap source of credit, with current rates averaging less than 5%. But borrowing against your home equity can be risky.” - Consider a Home Equity Line of Credit

From Houselogic

“So how can you decide if a HELOC is right for you? Start by understanding how this type of equity loan works, then carefully compare loan offers to ensure you’re getting the best terms for your circumstances.”

For an overview of provisions of the new tax reform law affecting current and prospective homeowners, see our story “Major Provisions of the New Tax Reform Law Affecting Homeowners.”

Home Ownership Matters will continue to provide ongoing updates and guidance on tax reform-related topics in the coming weeks.

Time to Focus on Affordable Housing

Taxes on real estate are not the answer. Sign the petition calling on Congress to address our country’s housing shortage.