Renters having their COVID-19 safety nets removed, face uncertain future

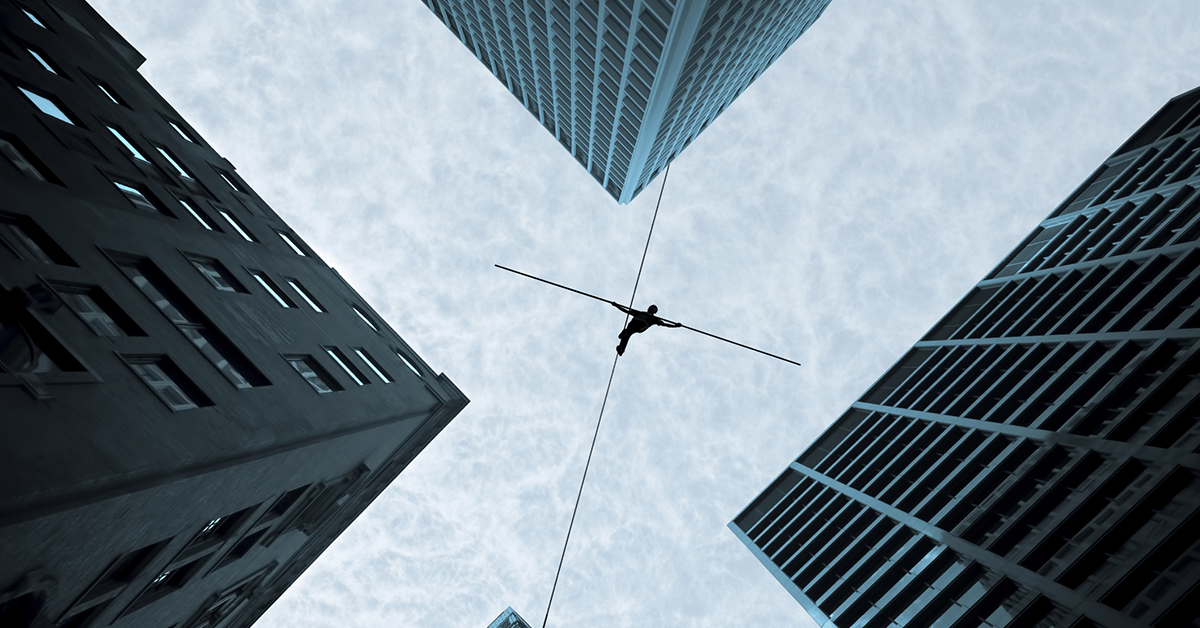

In the riveting documentary “Man on Wire,” the daring and dangerous act of Philippe Petit crossing a tight rope between the top of the World Trade Center towers in New York City in 1974 is chronicled. The death-defying stunt took six years of planning and was done, of course, without a net.

American renters, financially impacted by the COVID-19 pandemic, are about to feel the same intense anxiety as Petit.

Despite being out of work – whether they were laid off or furloughed, or had their hours greatly reduced because of the coronavirus – many renters have been able to survive financially because of actions taken by the federal government.

Getting an extra $600 a week in unemployment benefits or having Uncle Sam send a $1,200 stimulus check in the spring, as well as a moratorium on evictions has helped stem the tide.

But the extra $600 in unemployment stops at the end of July. Evictions can start again in August. And although a second federal relief package has been discussed, Congress and the White House do not have an agreement in place as of the time of this writing.

Couple that with a spike in virus cases across a large swath of the country and the future of jobs and the economy remain wildly uncertain.

Homeowners have more protections and supports in place to help get through this trying time, but renters have a far more stressful and unchartered future ahead.

Prior to the pandemic, renters in some parts of the country were already feeling the squeeze financially. Vacancy rates were low. Rents were high. Income levels weren’t keeping up.

The Harvard Joint Center for Housing Studies told the Associated Press that approximately 25 percent of all renters nationwide spent more than half of their income on housing.

Then came the pandemic.

The Associated Press added that according to U.S. Census data, 19 percent of renters were either late with their May payment or deferred it to a later time. Meanwhile, that same data indicated that 31 percent of renters who were surveyed in June had little-to-no confidence that they would be able to pay their July rent.

Protections were put in place during the early stages of the pandemic to help renters, but there’s no evidence yet that they will be re-implemented if a second wave of virus spread forces parts of the country to shut down the economy a second time. The National Association of REALTORS® sent a letter to congressional leaders in mid-July asking for a continued focus on housing security issues for Americans as part of any future pandemic relief packages, but nothing tangible in terms of proposed legislation existed as of the time of this writing.

When compared to homeowners, renters tend to be more vulnerable to sharp shifts in the country’s economy. They often have lower incomes and don’t usually have a line of credit to help them out. Meanwhile, homeowners can tap into their home’s equity in case of emergency.

Put all these factors together and it is estimated by the COVID-19 Eviction Defense Project that between 19 and 23 million people will be at risk for eviction by the end of September.

However some experts will tell you that projection, and others like it, are misleading.

If you are worried that you might end up unable to pay your rent, there are paths that you can take to ensure you continue to have a roof over your head come the fall.

- Reach out to your landlord – This should be the first step to see if there can be some sort of arrangement made to either offer a temporary discount or to defer payments of your rent.

- Federally subsidized housing – If your income has changed and you live in a federally subsidized unit, you may qualify for a rent reduction program. Contact your local housing authority.

- Check on other coronavirus relief programs – You may be able to free up some cash by filing for unemployment if you haven’t already. Also, check with your bank and/or credit card company to see if they offer any restricted payment plans for those impacted by COVID-19.

- Visit the National Low Income Housing Coalition’s web site. – There’s a list of rental assistance programs there.

- Visit org – A product of the United Way, this site provides links to charitable assistance for housing, food and other important needs.

- Checkout the Eviction Lab – This site had a constantly updated list of actions that can be taken to stop evictions.

- The Consumer Financial Protection Bureau also maintains a helpful chunk of information for renters on its website.

Whatever you do, you are not alone and there are groups that can and are willing to help you. You can get a certified housing counselor through the Department of Housing and Urban Development. You can find assistance from local and national organizations through Just Shelter, and the Stanford Legal Design Lab and Pew Charitable Trusts has a website to answer tenant questions about their legal rights.

Time to Focus on Affordable Housing

Taxes on real estate are not the answer. Sign the petition calling on Congress to address our country’s housing shortage.