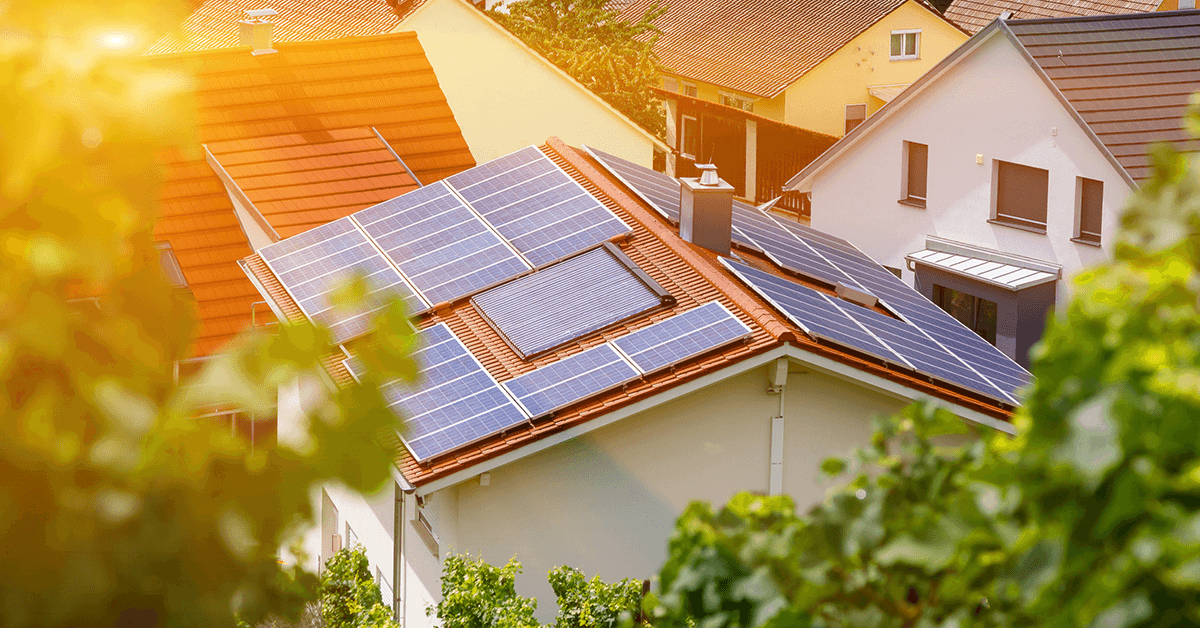

Tax Credits and Incentives Are Making Solar Power More Affordable for Homeowners

While the federal government continues to issue legislation promoting and protecting the use of coal, natural gas, and nuclear power, many states are making non-carbon electricity like solar energy a priority. In fact, 15 states are pushing for 100% carbon-free electricity by 2050. “States have a golden opportunity to continue moving the ball forward, and those that are aiming high are already seeing big results” said Emma Searson, Environment America’s 100% Renewable Campaign Director.

Homeowners that previously found the transition to solar power too expensive are now able to make the move thanks to the rebates, incentives, and tax credits that accompany these new energy policies. For example, EnergySage notes that by utilizing new energy savings programs, homeowners can install a solar panel system anywhere with a cost reduction of 26% to 50% depending on where they live.

In mid-April, Virginia Governor Ralph Northam signed the Virginia Clean Economy Act (VCEA) which made Virginia the first southern state to commit to providing 100 percent carbon-free electricity by 2050, an ambitious goal considering Virginia only produced 7% of its energy from renewable sources as of 2018. The act sets clear milestones to move the state toward clean energy. Virginia joins Colorado, New Mexico, Maine, New York, and other states who already have policies in place to advance them toward completely renewable energy sources by mid-century.

- Investment Tax Credit (ITC): Residential customers can take advantage of the solar Investment Tax Credit, which allows you, as a homeowner, to deduct a portion of your solar costs from your taxes, until December 31st, 2023. This credit, equal to 26% of the cost of your solar panel system, applies to the three major types of solar technology photovoltaic, solar heating and cooling, and concentrating solar technology.

- State Tax Credit: Some states offer additional tax credits for your solar panel system. State tax credits allow you to deduct a portion of your solar panel system from your state tax bill. The amount of the credit you’ll receive varies by state.

- Property Tax Exemptions: While not available in all states, this exemption allows you to avoid higher property taxes as a result of solar panel installation. Meaning if your property value rises as a result of adding solar panels, your state or local government may allow you to remove the added value for tax purposes.

- Sales Tax Exemptions: This exemption allows you to reduce the upfront costs of your home’s solar system by providing relief from state sales tax. Again, this exemption is not available in all states.

- Solar Renewable Energy Certificates (SREC): In states where legislation has been passed moving toward 100 percent carbon-free electricity, utility companies are required to generate a specific percentage of their power from renewable energy.

If you live in one of these states, your contribution to the grid will result in solar renewable energy certificates (SRECs). Prices for SRECs fluctuate based on supply and demand, like the stock market, but according to EnergySage selling your SRECs “can result in hundreds (or even thousands) of dollars per year in income depending on SREC market in your state.” To see these profits you need to own, not lease, your solar panel system.

- Performance-Based Incentives (PBI): Some states offer performance-based incentives (PBIs), which will pay you, the system owner, a per kilowatt-hour credit for the electricity your system produces. The price for PBIs is determined when the system is installed and since it’s not sold through a market the price will not fluctuate.

- Net Energy Metering (NEM): Net Energy Metering is a billing agreement between you and your utility company to measure your home’s energy use and production from and to the grid. Your input and output are measured by a meter that is installed by your utility company. If you create a surplus of energy you will receive a monetary or kWh credit which you can use when your system isn’t producing enough energy.

- Cash Rebates: You also have the possibility of receiving a cash rebate for your solar energy system. Some states, local governments, utility companies, or other organizations looking to advance solar energy, offer limited time (and quantity) rebates that can reduce the cost of your system by 10 to 20 percent.

Knowing the extent of the credits and incentives available to you in your state is just one of the steps on your journey to renewable electricity. Your friends, neighbors, or even local REALTORS® may have recommendations for reputable solar panel installers. The certification standard in the solar industry is the National American Board of Certified Energy Practitioners. Be sure your installer is licensed before signing any agreements. Your utility company or your installer can help you:

- Assess your solar potential.

- Assess your options for using solar.

- Estimate your solar electricity needs.

Installing solar panels may seem like a daunting and expensive process. However, depending on the state you live in and your current and future electricity usage you may see savings between $10,000 – $12,000 over a 20 year period all while increasing your home’s value by $14,329 on average. With energy costs on the rise and a multitude of credits and incentives available, making renewable energy a part of your future may be the right idea.

Time to Focus on Affordable Housing

Taxes on real estate are not the answer. Sign the petition calling on Congress to address our country’s housing shortage.