The Importance of Preserving Homeownership Tax Incentives

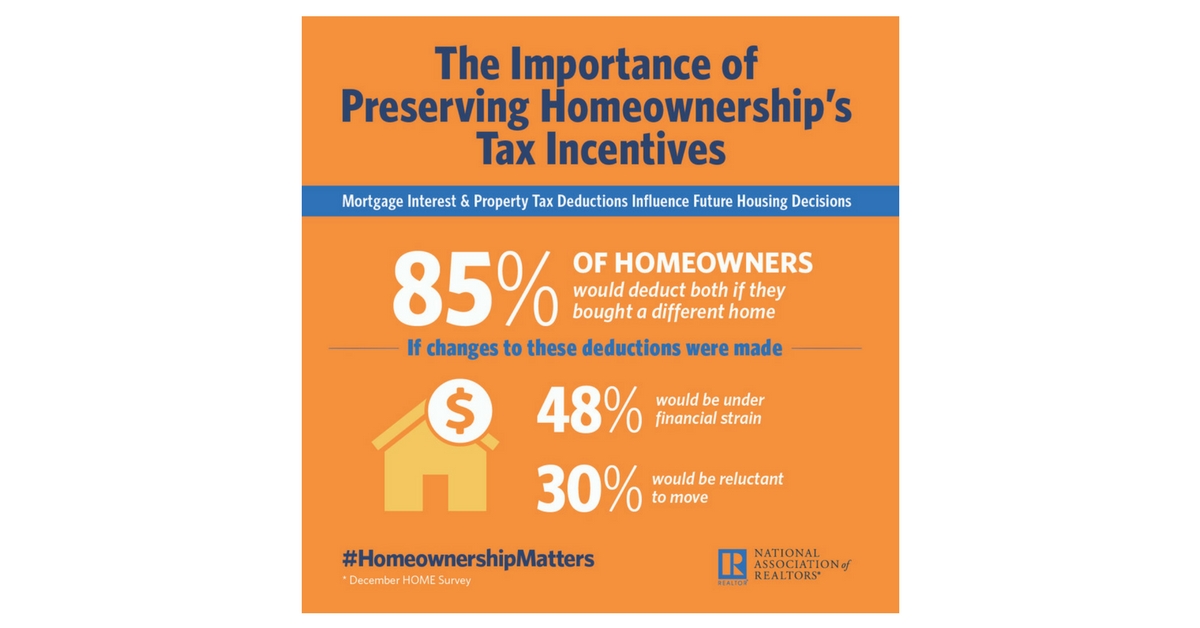

If there were ever a doubt that mortgage interest and property tax deductions influence future housing decisions, there shouldn’t be any longer.

That’s because a new poll shows that 85% of homeowners would deduct both if they were to buy a different home.

Furthermore, if changes to these deductions were made, as is being proposed in tax reform legislation currently being worked on by a joint committee of U.S. Senators and Representatives, nearly half (48%) of these same homeowners would experience financial strain and nearly a third (30%) would be reluctant to move from their current home.

This data comes from the National Association of Realtors® fourth quarter Housing Opportunities and Market Experience (HOME) survey.

The findings clearly indicate the proposed tax reform legislation eliminate key incentives to owning your own home.

“Homeownership is an aspirational goal for millions of Americans, but getting there isn’t always easy,” said NAR President Elizabeth Mendenhall, a sixth-generation Realtor® from Columbia, Missouri and CEO of RE/MAX Boone Realty. “Middle-class families count on tax incentives like the mortgage interest deduction and the state and local tax deduction to make homeownership a more affordable prospect.

“Realtors® will continue to advocate for these and other important provisions as the tax reform debate continues.”

Realtors® still have an opportunity to influence Congress to help make the tax reform bill more favorable to homeowners and consumers. Important improvements in the legislation are possible by encouraging Congress maintain the current law for the mortgage interest deduction and capital gains. Congress can also address the State and Local Tax Deductibility issue by expanding the provision to include income taxes, raising the cap and indexing the cap to inflation. These changes and retaining the current law makes the bill more favorable to homeownership.

Time to Focus on Affordable Housing

Taxes on real estate are not the answer. Sign the petition calling on Congress to address our country’s housing shortage.