A Bipartisan Effort to Make Homeownership More Affordable

The Housing Opportunity Through Modernization Act was hailed as a significant step towards eliminating barriers to safe, affordable mortgage credit for condominiums when it passed in July 2016.

Two years later, 52 Senators and 120 members of the House of Representatives from both sides of the aisle are calling on HUD Secretary Ben Carson to finally make condominium ownership a more feasible option for American families by issuing the final rule for this legislation.

According to industry statistics, condominiums remain one of the most attainable and affordable options for first-time homeowners, minorities, and older residents.

Members of Congress Request Final Rule

In part, the Senators wrote:

“…the Housing Opportunity Through Modernization Act was signed into law on July 29, 2016. Section 301 of the statute makes a number of changes to the Federal Housing Administration’s (FHA) condominium rules that would streamline and simplify requirements for condominium buildings to qualify for FHA approval… Unfortunately, nearly two years later, the final rule has yet to be issued. At a time when homeownership remains out of reach for far too many families, the FHA should expand affordable and sustainable access to home mortgage credit by issuing a final condominium rule.”

Members of the House wrote:

“Unfortunately, the final rules have yet to be published, and these markets remain stymied from new growth. FHA’s current rules place significant restrictions on the purchase and sale of condominiums, even though they are often the most affordable homeownership option for first-time buyers, small families, and urban and older Americans. Condominiums offer residents access to amenities, services, and public transportation that build stronger communities and promote sustainable homeownership.”

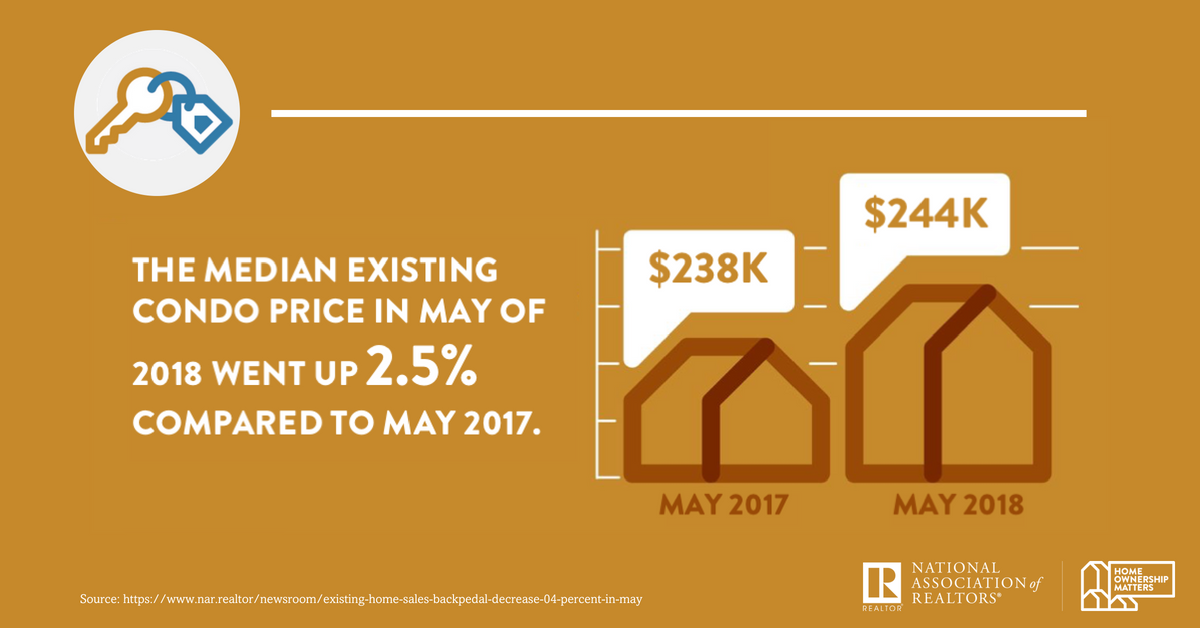

While the cost of condos has increased, overall condos are more affordable. The median existing single-family home price was $267,500 in May, which is $23,500 more the median price for a condo.

As an example of how condominiums offer a more affordable path to home ownership, in the Myrtle Beach, South Carolina area the average cost of a condo is 40 percent less than the cost of a single-family home. However, the current pace of the FHA’s approval process for condo applications for FHA insurance coverage has not kept up with demand. More than 80 percent of condos in consideration for FHA insurance coverage in South Carolina have outstanding applications.

Impact Of The Final Rule

In the end, the rule is design to:

- help stabilize condominium associations

- ensure that homeowners will be able to sell their units more easily

- provide homebuyers more opportunities to buy affordable properties

When finalized, the rule will be easier for individuals to finance condominium loans, while continuing to protect borrowers and maintain necessary safeguards to the FHA Mutual Mortgage Insurance Fund.

Time to Focus on Affordable Housing

Taxes on real estate are not the answer. Sign the petition calling on Congress to address our country’s housing shortage.