UNDERSTANDING BOZEMAN’S TAX CHALLENGES

Finding a place to live in Bozeman—and being able to afford it—has become a challenge. And homeownership has grown even more elusive for too many residents.

Keeping homeownership in Bozeman affordable STARTS with understanding the many local tax issues impacting our market.

Please join us on October 8th to learn more about Bozeman’s thriving economy, the growing local tax burden and how the city plans to address it.

PLEASE JOIN US:

Know Your Bozeman Taxes – Tax Education Panel

Tuesday, October 8, 5:00 – 6:30 p.m.

Masonic Temple, 14 South Tracy, Bozeman, MT

HOW WELL DO YOU KNOW YOUR LOCAL TAXES?

We’ve created a series of infographics to help explain Bozeman’s growth, the increasing cost of living and the impact the growing tax burden is having on residents.

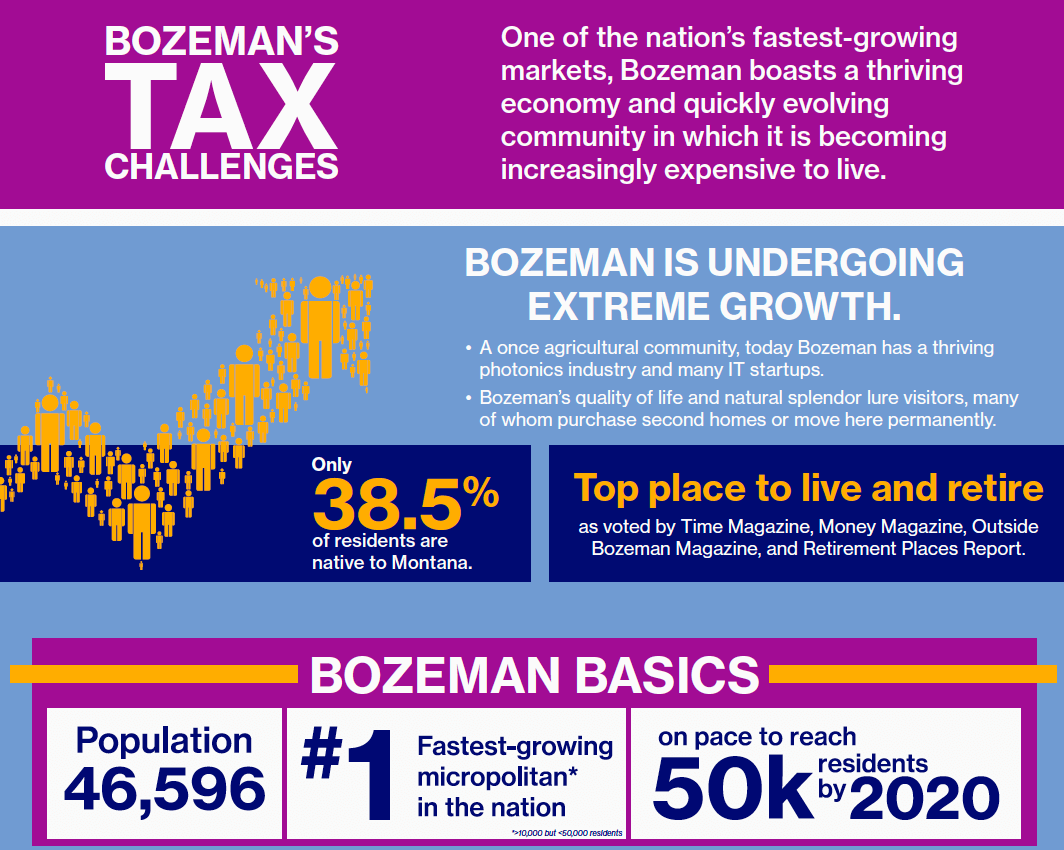

Bozeman’s Growth Challenges

Did you know that Bozeman is one of the fasting growing cities in the country with a thriving economy? For many, that means our city is becoming increasingly expensive to live in.

LEARN MORE

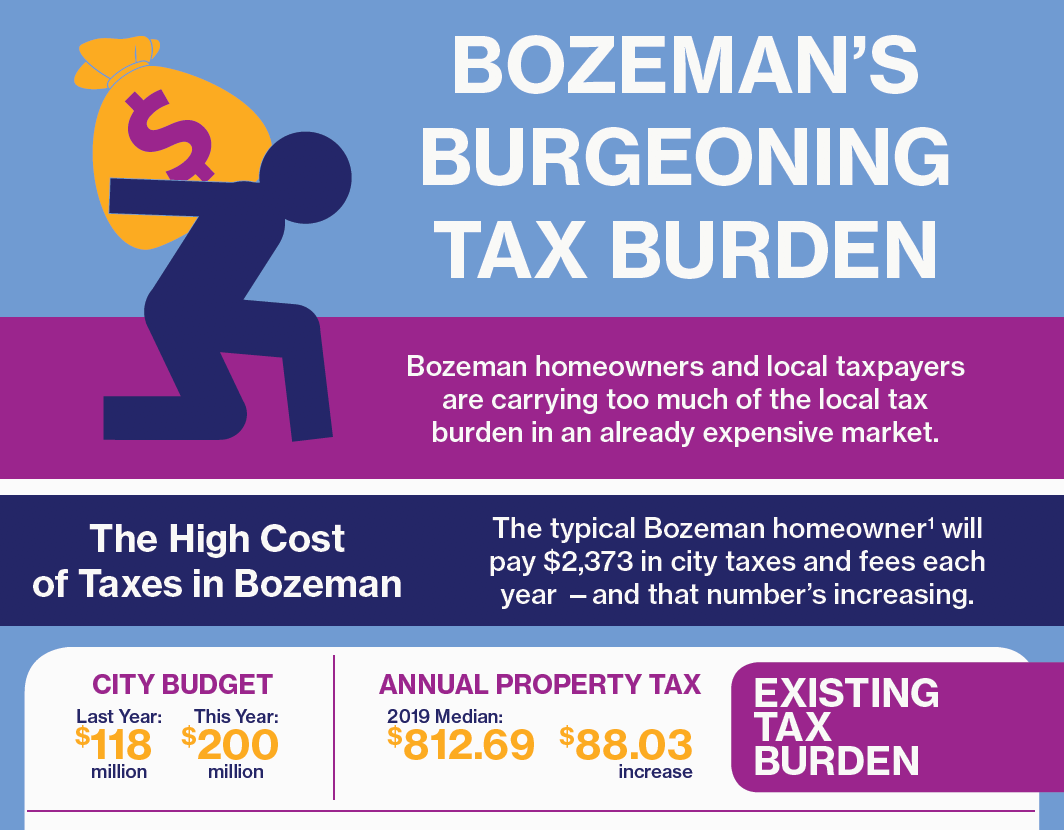

Bozeman’s Burgeoning Tax Burden

Did you know that Bozeman homeowners and other city residents carry most of the local tax burden?

LEARN MORE

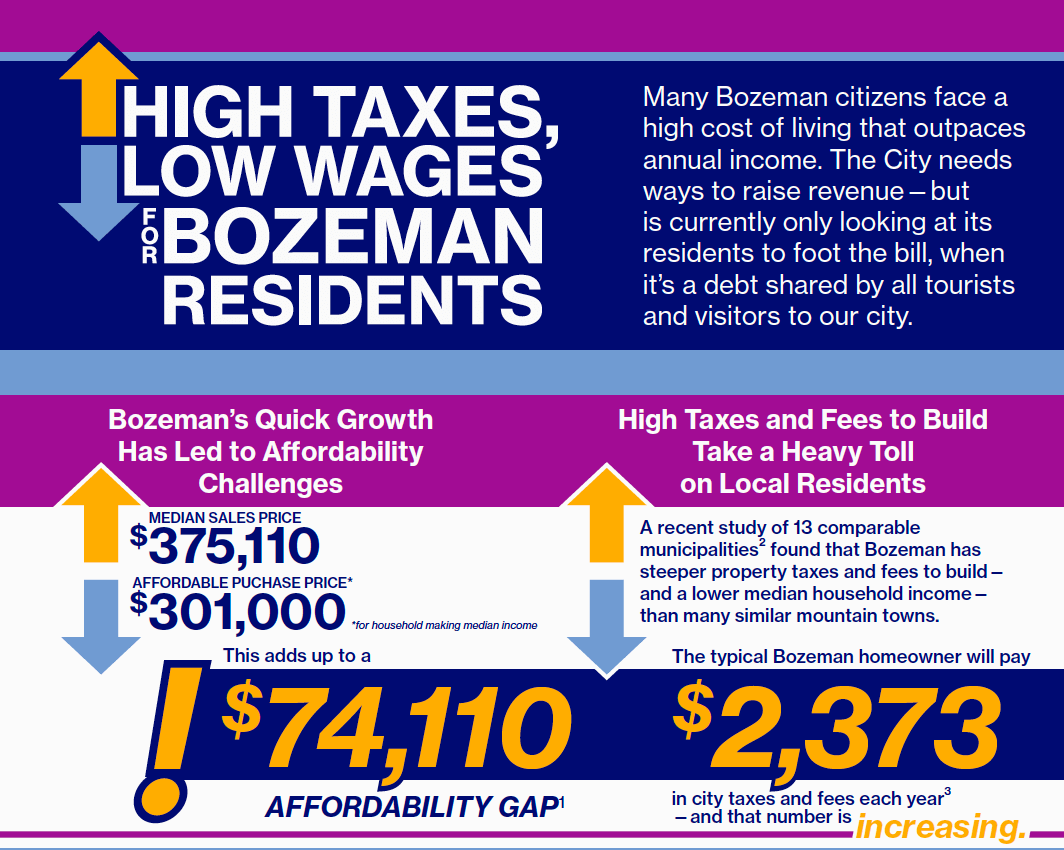

High Taxes, Low Wages for Bozeman Residents

Were you aware that the city is currently only looking to its residents to pay local taxes, when it’s a debt shared by all tourists and visitors to our city?

LEARN MORE

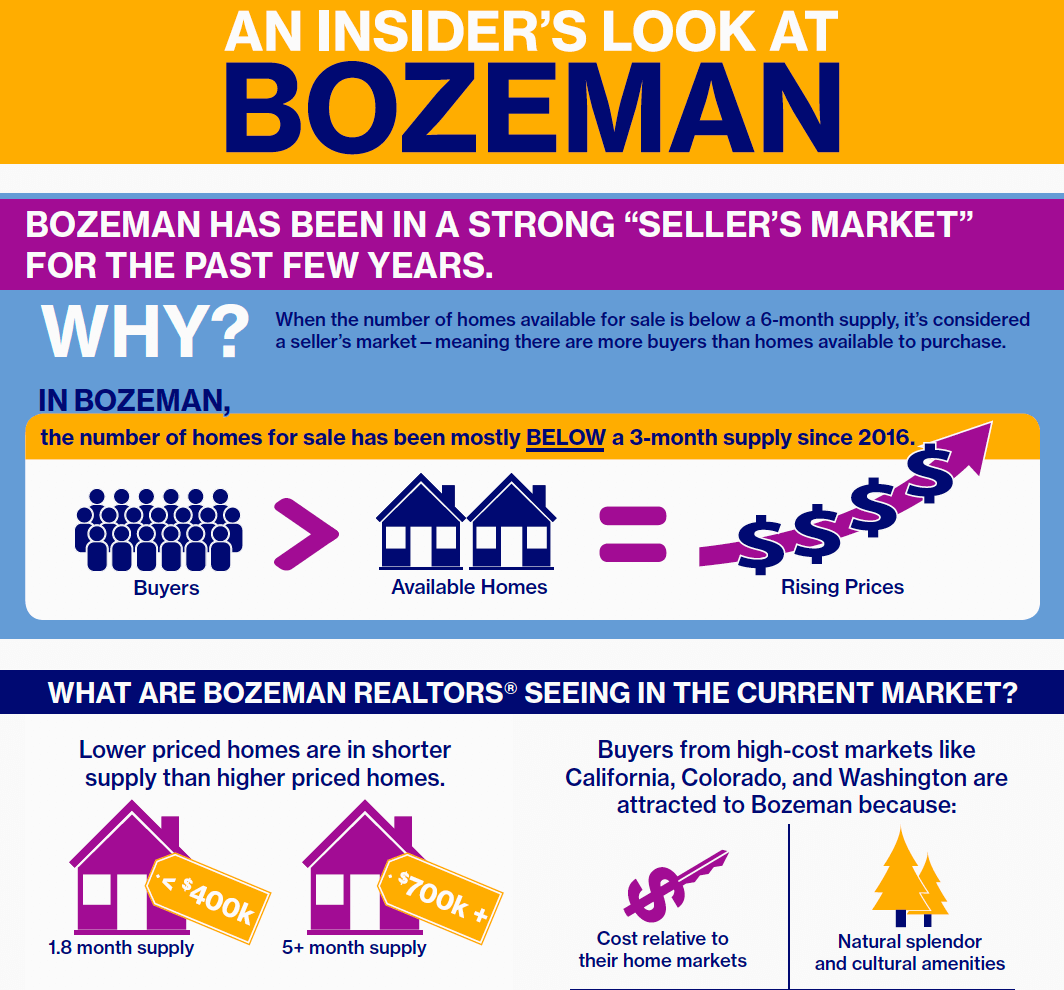

An Insider’s Look at Bozeman

What do you know about home-buying trends in Bozeman? Who’s buying, who’s selling, and who’s struggling?

LEARN MORE

PLEASE JOIN US:

Know Your Bozeman Taxes – Tax Education Panel

Tuesday, October 8, 5:00 – 6:30 p.m.

Masonic Temple, 14 South Tracy, Bozeman, MT

TAX TERMS EXPLAINED

We’ve put together a short glossary to explain frequently used tax terms to help you better understand the tax policies being proposed by the city.

Appraised Value

The appraised value of a property describes the determination of an exact number regarding its value. Value is subjective based on comparable property and appraiser opinion.

Assessed Value

An assessed value is the dollar value assigned to a property to measure applicable taxes. Assessed valuation determines the value of a residence for tax purposes and takes comparable home sales and inspections into consideration. The assessed value is often much less than the market value so buyers would prefer the assessed value while sellers would much rather sell at the market value of the home.

Market Value

Market value is the most probable price that a property should bring in a competitive and open market under conditions requisite to a fair sale, the buyer and seller, each acting prudently, knowledgeably and assuming the price is not affected by undue stimulus. The market value has more variance than the appraised value. Unlike the appraised value, buyers have influence over the market value of a property because a property is only worth what a buyer is willing to pay.

Mill Levy

A mill levy is a property tax that is based on the assessed value of a property. The rate of this tax is expressed in mills. One mill is equal to $1 for every $1,000 of assessed value.

Special Improvement District (SID)

The City of Bozeman has created assessment districts for several neighborhoods under Montana law. Depending on where you live or own property in town, you may be subject to: Street Maintenance, Tree Maintenance, Street Paving, Street Lighting, Business Improvement, Tourism Business Improvement and Infrastructure Improvements.

Tax Increment Financing (TIF)

Tax increment financing (TIF) is a public financing method that is used as a subsidy for redevelopment, infrastructure, and other community-improvement projects in many countries, including the United States. Similar or related value capture strategies are used around the world.