Opportunity Zone Projects in Duluth Are Having An Impact

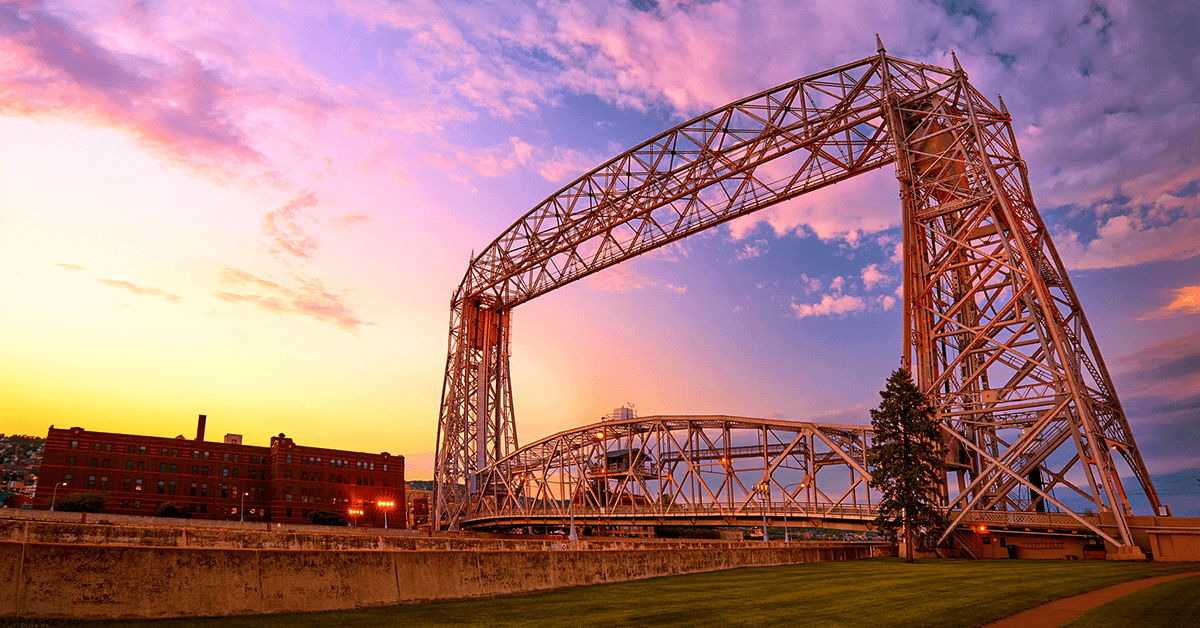

There are five adjacent census tracts in Duluth, Minn. spanning six miles that are the very definition of disadvantaged neighborhoods.

In that small swath of the city, there is a 41 percent poverty rate, a 13.8 percent unemployment rate and an average income that is just 43 percent of the median for the entire area.

It is in communities like these that the opportunity zone program that was part of the Tax Cuts and Jobs Act of 2017 was meant to make a difference.

And in a town like Duluth, that appears to be the case.

According to the Duluth News Tribune, there are six active projects in this area worth approximately $125 million in investment with another six prospective projects in the pipeline, all taking advantage of the opportunity zone program to help revitalize a community that is in great need.

These opportunity zone projects are taking place all over America, with hundreds of areas having been identified as opportunity zones for investors.

And while the concept of opportunity zones has been around for a long time at the state level, it’s only been approaching three years now at the federal level – and the result of that they are finally starting to bear fruit.

Each state has census tracts that are identified as opportunity zones – areas that are primarily disadvantaged that could benefit from investment and development, which would create jobs, more community safety and revitalize once thriving neighborhoods that have faded or been forgotten in time.

In the example above, Duluth has five of the 128 census tracts identified in the state of Minnesota. There are approximately 8,700 opportunity zones nationwide.

The incentive for investors to fund projects in opportunity zones is a significant tax benefit. Investors can avoid paying capital gains tax on investment by rolling the profits from that investment into a qualified opportunity fund specializing in identifying projects in these designated zones.

An investor who holds that investment for at least five years can defer 10 percent of their capital gains taxes and after seven years can defer 15 percent.

But the carrot that dangles most lucratively from the stick is that capital gains taxes are wiped out entirely with a 10-year investment in an opportunity zone.

Chicago real estate investor Larry Levy teamed up with a pair of private equity firms and are pledging to sink $750 million into opportunity zones across the country.

This is their second go-round in raising capital to invest in opportunity zones. The first time led to raising $465 million in investments in seven projects. Most of these developments are coming in places like Phoenix or Portland, Ore, and not in Chicago, which is having a hard time attracting investors to its 135 opportunity zones.

That means the tax breaks are attractive to the investors, but secondarily to the viability of the project. If the investors don’t believe a certain project will work in a certain community, they’ll pass and go elsewhere looking for more certainty for their investment dollars.

The co-owners of the Sacramento Kings, a franchise in the National Basketball Association, have committed $850 million in investment dollars to opportunity zones that are near sports complexes, according to Bisnow.

However, Alex Bhathal and Ryan Parkin, managing partners of RevOz, the company that owns the Kings, are not investing in the state of California where their basketball franchise is located.

They did invest in the development of a medical office building in San Bernadino in a qualified opportunity zone, but that may be the only investment in California for the foreseeable future, even though the state has 879 opportunity zones available to investors.

That’s because California has taken a hard line on the tax breaks that are afforded to opportunity zone investors.

It is one of just four states in the country to not fully conform to the tax advantages as outlined in the 2017 federal legislation.

There are a variety of reasons for California not fully getting on board the opportunity zone train, but mostly the state’s reluctance has come from legislators unwillingness to learn or understand the complexities of the program or also a fear of gentrification, that would displace minorities from the homes and communities that they know.

Without full conformity by the state, investors would still have to pay a c13.3 percent capital gains tax upon departing from the investment.

While it seems like a good investment to help rehabilitate distressed areas of the county, the true impact of opportunity zones won’t be felt for years, and while there are sure to be some areas that were successes, there might also be some that fail to meet expectations.

Venroy July, an attorney in Baltimore and a partner with Miles and Stockbridge told the Charleston Chronicle that the first wave of investments are sure to be successful because big money investors were going to throw their dollars behind the most attractive projects.

But the real test for opportunity zones will be the smaller projects that come down the road.

An example in Baltimore that July referenced was Yard 56, a mixed-use project converting a 20-acre shuttered industrial site into a retail development center that will include a gym, a supermarket and other shops and restaurants.

The all-important second phase of the development will include office space, residences, a hotel and some more retail.

“It will take time to see if capital goes into the next layer of projects and into areas that are not as attractive,” July said. “Once we get into the second, and third layer investments, we’ll begin to see the true potential of what Opportunity Zones can accomplish.”

He added that the investments that are in the hundreds of thousands of dollars as opposed to the tens of millions of dollars will allow for the development of the neighborhoods surrounding the big, sparkly initial investments.

Projects pursued by churches, fraternal organizations and others that can pool resources to invest in their communities will determine which opportunity zone projects are successful and which aren’t.

“There is already a trust relationship within these organizations,” July said. “If they plan strategically, members can put together a well-thought-out plan for urban renewal in the communities where they live, without bringing about displacement. Such investments can actually enhance these communities, while also helping to create generational wealth for African Americans and others.”

Time to Focus on Affordable Housing

Taxes on real estate are not the answer. Sign the petition calling on Congress to address our country’s housing shortage.