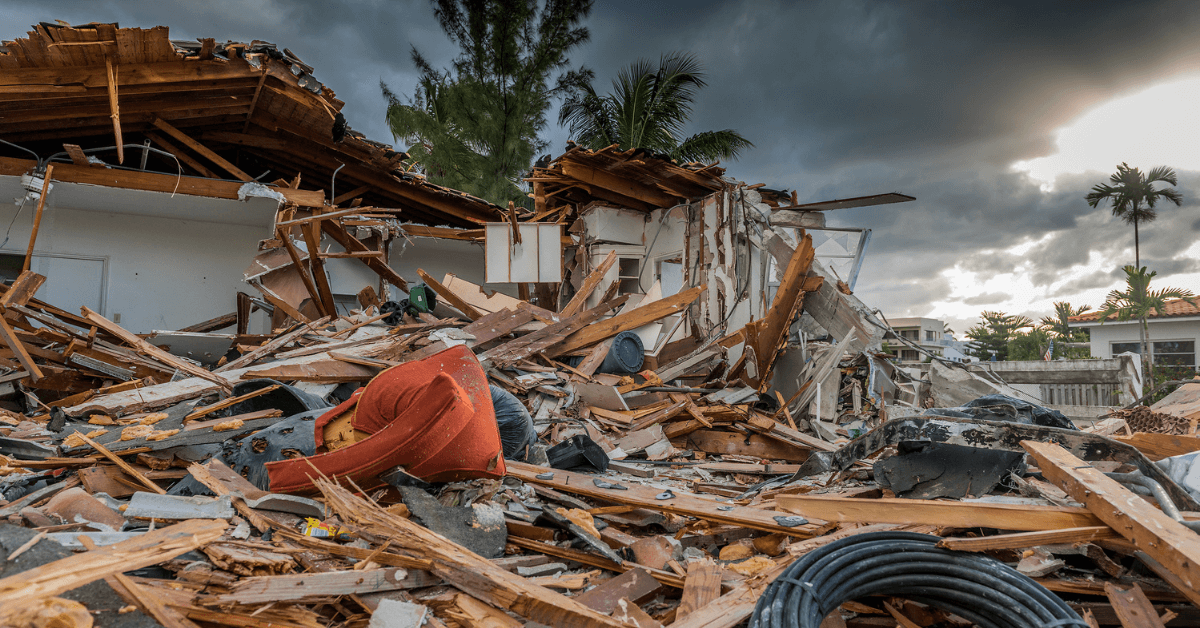

What to Do When Disaster Strikes: Rebuilding After a Hurricane

The 2020 hurricane season has been wreaking havoc along America’s Southern Atlantic coast. Tropical Storm Marco made landfall near the mouth of the Mississippi River in Louisiana on August 24th. Then, just three days later, Hurricane Laura, hit Louisiana and Texas with 150-mile-an-hour winds. More than 1.5 million people in the coastal regions of Texas and Louisiana were put under some form of evacuation orders, according to the New York Times.

Hundreds of thousands of customers are already without power in Louisiana, and over 100,000 are without power in Texas. But how much destruction will greet homeowners as evacuation orders are lifted and residents return home remains to be seen. For many, they are likely to find extensive damage to their homes and property from flying debris, high winds, and floodwaters.

Figuring out what to do when you’ve lost it all to a devastating hurricane is an overwhelming and emotional task. Here is what you can do to rebuild if your home has been damaged or destroyed by these recent storms.

After you’ve received notice that it is safe to return home after a hurricane, it’s time to assess the damage. The most important piece of that assessment is to determine whether or not your home is habitable. A habitable home is defined by the Federal Emergency Management Agency (FEMA) as, “one that is safe, sanitary, functional, and presents no disaster-caused hazards or threats to the occupants.”

If you’re looking to seek additional living expenses (ALE) from your insurance policy, you’ll need to demonstrate that your home is uninhabitable. But what does that really mean? Housing rules and habitability standards vary by state and even by county and city. FEMA uses the following factors to determine habitability:

- The exterior is structurally sound, to include windows, doors, and roof.

- The electricity, gas, heat, plumbing, etc. are functional.

- The interior is structurally sound, to include floors, walls, and ceiling.

- There is safe access to and from the home.

- The septic and sewer systems are functioning properly.

- The water supply or well (if applicable) is functional.

If you believe your home is uninhabitable as the result of hurricane-related damage, you should contact your insurance company to access your policy’s ALE coverage. Your insurer will likely send an adjuster to your home to help you determine the value of what was lost in the hurricane.

To receive ALE, the damage to your home must have been caused by a condition covered by your policy. Most standard homeowners’ insurance policies don’t cover flooding or windstorms, two catastrophic results of hurricanes. However, Don Griffin, vice president of personal lines at the American Property Casualty Insurance Association, notes in the article Tropical Storms Marco and Laura: Insurance Typically Covers Some, But Not All, Damage, “In most coastal states like Texas, Florida, and Louisiana, they have what they call coastal programs.” He continues, “What it does is if windstorm is excluded in the policy, you can buy it back through the state’s program.” You should check with your insurer to see what is included in your policy.

The ALE feature of your homeowner’s insurance policy will pay for additional costs of temporarily living somewhere else while your home is repaired or rebuilt. ALE typically covers:

- Hotel bills

- Rent for temporary housing

- Restaurant meals

Be aware that ALE is generally capped at around 20% of the dwelling coverage and comes with a time limit for usage. According to Diane Swerling, a principal at Swerling Milton Winnick Public Insurance Adjusters Inc., this means “if your home is insured for $200,00, you have up to $40,000 to spend on additional living expenses.” These funds would last through the designated period of time in your policy.

When it comes to temporary housing, you’re entitled to maintain your standard of living. While your insurer will typically work with you to find a good and comparable fit, Swerling notes that a REALTOR® will have a better grasp on local inventory than an out of state insurer.

Mortgage companies require homeowner’s insurance to protect themselves against natural disasters like hurricanes. As long as the damage to your home was caused by a covered event, your homeowner’s insurance will cover your additional living expenses and the cost to repair your home, which will free you up to continue making your mortgage payments.

If your home is completely destroyed by a hurricane, your insurer will pay off your mortgage. However, the article Do You Have to Pay Your Mortgage if Your House is Destroyed notes, “Whether you’ll receive enough to rebuild your home in addition to paying off your mortgage depends on what coverage you purchased when you selected your policy. ‘Replacement value’ coverage is not standard, and you pay extra for that option.”

If you’re unable to pay your mortgage because of a hurricane, perhaps because you are unable to work temporarily, you can request a mortgage forbearance from your lender. These agreements allow you to make partial payments or skip payments without any damage to your credit. Be mindful that you will still be accruing interest during this time.

Whether you pay your mortgage, your insurer pays your mortgage, or you request a forbearance, you should contact your lender to let them know about your situation and find out the specifics for payment given your personal situation.

There are a variety of disaster relief options available to homeowners who live in a Presidentially designated disaster area. These programs can help fill in the gaps left by your insurance coverage.

- FEMA’s Individual Disaster Assistance: Homeowners who need assistance with housing beyond what is provided by their insurance policy can apply for FEMA’s Individual Disaster Assistance. If you’ve filed an insurance claim FEMA can provide you assistance if:

- Your settlement is delayed.

- Your settlement is not enough to cover your disaster-caused needs.

- You’ve used all the ALE offered by your insurer.

- You’re unable to find a rental unit.

- The United States Department of Housing and Urban Development’s (HUD) Mortgage Insurance for Disaster Victims Section 203(H): HUD’s Section 203(H) program provides mortgage insurance to protect the lenders of homeowners whose homes were destroyed or extensively damaged during a hurricane or other natural disaster. These zero down payment mortgages can be used to finance the reconstruction of your primary residence. This program is designed to be affordable, but not free. You will pay an up-front insurance premium at the time of purchase and you will also pay monthly premiums.

- The Department of Homeland Security’s Disaster Assistance Website: gov can help you determine if your home lies in a Presidentially designated disaster area. Their simple online survey can help you determine which assistance programs are right for you. You can also register for assistance on this site and check the status of your application.

Tropical Storm Marco and Hurricane Laura have already caused extensive damage when they made landfall last month. Downed trees, destroyed houses, and flying debris can leave you with a lot to clean up when you’re able to return home. In most cases, debris on the street and any debris that may obstruct emergency vehicles will be removed by your city or town.

For debris on your property, there is a good chance your insurance policy will cover its removal. Some homeowner’s policies include debris removal through the category of “additional coverage.” If you live in a coastal community where hurricanes are common, you expect to pay a higher premium for a debris removal rider.

If your policy contains this rider and your home is damaged by debris from a covered loss, in this case, a hurricane, your insurer will cover the debris’ removal for “a maximum amount of coverage equal to 25 percent of the amount paid for the direct physical loss, plus 25 percent of the amount of the deductible.” That means if you have $20,000 of damage, 25 percent of that is $5,000. If you have a $1,000 deductible, 25 percent of that is $250, meaning the maximum coverage you’d receive for debris removal would be $5,250. However, if there is debris on your property that did not cause any damage to your home, the cost for the removal of that debris would not be covered by your policy.

Once you’ve secured temporary housing, contacted your mortgage company, filed your insurance claim, requested additional disaster relief assistance, and cleared away the debris, you’re ready to begin rebuilding your home.

Your insurer will provide you with the amount you set in your policy to rebuild your home. Keep in mind that if you estimated the price to rebuild based on your mortgage amount or the market value of your home, the actual cost to reconstruct your home may exceed that figure. With lumber in short supply due to supply chain issues caused by COVID-19, you may find the cost of materials higher than expected. You should also consider that if you made upgrades to your home, but didn’t update your policy, recreating those improvements may not be possible with your insurance payout.

As you rebuild, if you’re financially able, you should consider making upgrades to your home that may protect you and your property when the next hurricane strikes. Common hurricane proofing upgrades for new construction include:

- Installing storm shutters or impact-resistant windows and doors.

- Adding a roof-tie down system.

- Building your home with a continuous load path.

- Using stormproof building materials like reinforced concrete.

- Designing a round house to resist wind pressure.

These back-to-back tropical cyclones are hitting the Southern Atlantic coast hard. Homeowners and the communities they live in have a big rebuilding task ahead. Knowing how to start the rebuilding process and where to go while you do it is the first step on the journey back home.

Time to Focus on Affordable Housing

Taxes on real estate are not the answer. Sign the petition calling on Congress to address our country’s housing shortage.