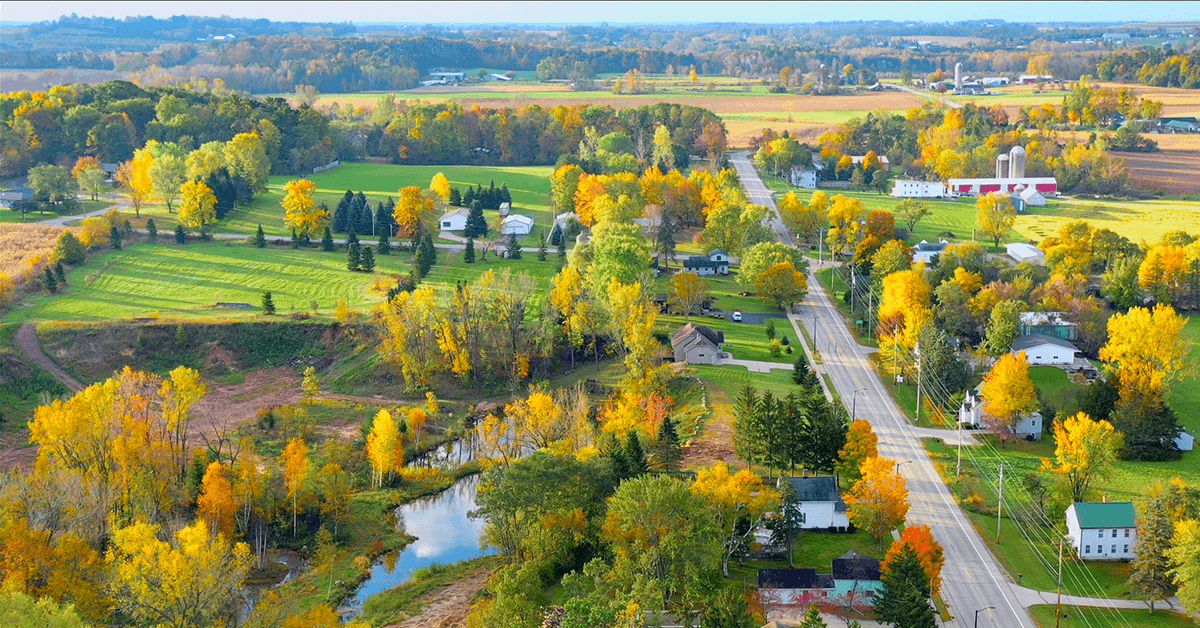

Record Low Mortgage Rates Make Northeast Wisconsin’s Housing Market Heat Up

Wisconsin may be known as America’s Dairyland, but this midwestern state has a lot more to offer than tasty cheese. Wisconsin’s housing market endured 2020 despite the slew of obstacles. Between record low mortgage rates and an already affordable housing market, Wisconsin jumped out on the map for many newcomers. Over the course of 2020, Wisconsin saw houses fly off the market, some without even having a scheduled showing in counties such as Outagamie.

In the summer of 2020, real estate experts weren’t entirely sure how the rest of the year would pan out, as many assumed the market would have crashed by then but to their surprise, they saw much more promising action in the housing industry. Milwaukee County Benefit Realty broker, Jamie Desjardin-Rummel, spoke of the aggressive competition as the housing demand began outweighing the supply. “Things are going a lot higher, they’re getting a lot crazier, and we have to be a lot quicker to get our people in the houses,” Desjardin-Rummel said. While many expected the pandemic to be the culprit of housing market woes, the low mortgage rates came to the rescue.

Marquette University economics professor David Clark speaks of the record low mortgage rates in the spring of 2020, “We have never seen 30-year fixed rate mortgages as low as they were in the month of May. Those are awfully favorable credit conditions for someone who’s looking for a home.” As the market started heating up, it became a great environment for sellers.

As for Northeast Wisconsin, Outagamie County, in particular, the low mortgage rates fueled an extremely successful year within the housing industry and the market will likely continue to flourish through 2021. With the high demand, it is a seller’s market indeed. This past fall, the midwestern state was seeing homes selling for full price in just a day or two. Outagamie County resident Ashley Williams took the hot seller’s market as a sign to sell her home in late September 2020, which sold in one weekend. Although, as for buying, the process wasn’t as seamless. Williams wasn’t even able to schedule a showing before a house was swiped off the market, clearly showing that buyers are committing to purchasing without even taking a look at properties. Essentially, as long as the listing price is level with other houses on the market, it will sell in the blink of an eye. Williams’ realtor advised her to make an offer within two hours if she wanted any chance of calling a house her new home. Sellers started to catch on to the eagerness of buyers and also began seeing their flexibility when it came to the selling process. Sellers didn’t have to organize multiple showings with their realtor, due to the competitive buyers that would make an offer without skipping a beat as well as the COVID-19 related safety measures that were being taken at the height of the pandemic. The introduction of online offers definitely increased interest and accessibility for buyers in other regions.

The hype continued, according to WPR, who reported strong home sales into this year. The Wisconsin Realtors Association reflected 4,659 existing home sales as of late February, which is a 9.8 percent increase from January of 2020. The demand is not the issue, Clark confirms, supply is the issue. “We’re down 35 percent from where we were this time last year. At some point, and especially as you move into those higher volume months, the number of homes that are available for sale just shrinks to the point where it’s going to start influencing significantly the number of closings,” Clark says. The high demand maneuvered an increase in home prices, bringing the median listing price in Outagamie County to $209.9K, and the overall state’s median home price jumped 10.5 percent.

With a rather low median home price, especially when compared to cities such as Seattle and Boston with median home prices of over $715,000, Wisconsin remains affordable and in turn, popular. Realtors Association data found that more Wisconsin homes sold this past summer than ever before. As Davies says, “We’ve got great interest rates, affordability is amazing, you can get way more house than your money but it’s just finding that house.” While obstacles are sure to arise with low inventory, the market is still thriving. The low mortgage rates seem to outweigh the low supply in Wisconsin and experts believe that affordable homes will still be obtainable just as long as mortgage rates remain low.

We’ve now seen the low mortgage rates begin trickling back up, but perhaps not to stay. Rates are remaining historically low. Bankrate surveyed large lenders as they do weekly, and as of March 24th, the mortgage rate on a 30-year mortgage averaged 3.31 percent. Just one week prior it was 3.34 percent, and a year ago it was at 3.75 percent. After the whirlwind of 2020, experts are likely hesitant to predict the upcoming months in the real estate market with confidence. Although, in a weekly poll, Bankrate found that 38 percent of respondents believe rates will fall and about that same percentage predicts that rates will stay the same. The remaining 23 percent expect that the rates will rise. Chief financial analyst over at Bankrate, Greg McBride, says “The bond market seems to have settled down after the latest surge in yields, bringing some welcome tranquility to mortgage rates – at least temporarily.”

With the future looking bright for Northeast Wisconsin’s housing market, now is the time to get your foot in the door. Whether you’re a seller, buyer, or strictly an investor, the market will continue to change and these circumstantial benefits may not always be available to aid you in the process. Even if you’re planning on staying in your home forever, you could benefit from refinancing your home to take advantage of the current low mortgage rates. Each situation is different, but if refinancing is the right decision for you, it can score you a better loan, increase your net worth and even lower your monthly payment. As for buyers, broker Desjardin-Rummel’s advice is to seek out a home that needs some renovations. “The market isn’t going to stay this way forever, and you’d hate to get into your first house, purchase something at the peak of value and not have any equity in it when you decide to upgrade,” Desjardin-Rummel expresses.

Time to Focus on Affordable Housing

Taxes on real estate are not the answer. Sign the petition calling on Congress to address our country’s housing shortage.